PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

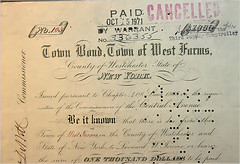

1868 MUNICIPAL BOND COMING DUE AFTER 135 YEARS Arthur Shippee forwarded this New York Times article about a very long term municipal bond. -Editor  Anyone who has failed to keep track of a winning lottery ticket for all of 12 months may want to consider the efforts of 39 bondholders who have been safekeeping valuable, tissue-thin, New York City securities since shortly after the Civil War. Anyone who has failed to keep track of a winning lottery ticket for all of 12 months may want to consider the efforts of 39 bondholders who have been safekeeping valuable, tissue-thin, New York City securities since shortly after the Civil War.Next month, one of the bonds, issued in 1868 and thought to be one of the oldest active municipal bonds in the country, will come due. And the city stands ready to retire the debt incurred when Winston Churchill’s grandfather came up with the idea of building a road to one of the nation’s first racetracks, which he had opened in what is now the Bronx. For 135 years, New York City has been dutifully paying 7 percent annual interest on the bonds, which financed construction of the road. On March 1, the owner of one of them is entitled to come forward and collect its face value: $1,000. The other 38 bondholders have notes that will mature sometime between now and 2147, a mere 138 years away. “It’s not the best example of municipal debt management,” said Jim Lebenthal, a bond specialist. “But 135 years of payment without missing a beat does underscore the safety record of municipal bonds.” To read the complete article, see That’s What You Call Investing for the Long Term (www.nytimes.com/2009/02/13/nyregion/13jerome.html?_r=1) Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|