PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

LIBERTY DOLLARS VS COMMUNITY CURRENCY

The previous article on Liberty Dollar founder Bernard von notHaus mentions the Ithaca Hour community currency. I contacted Paul Glover, founder of Ithaca Hours, and he sent me something he had written last year when von Nothaus was on trial. Thanks! Paul lays out the distinctions between Liberty Dollars and community credit systems like Ithica Hours.

-Editor

Occasionally there are attempts to intimidate independent currency issue. Bernard Von Nothaus was convicted in 2011 for issuing Liberty Dollars, coins backed by silver that significantly resemble United States money. Lawyer Bill Rounds replied, “Congress [has] the power to punish counterfeiting the coins that they themselves produce, and probably to punish coins resembling genuine United States coins. Again, there is absolutely no mention of private coinage. In fact, the definition of private coinage is that it is not the current coin of the United States. Therefore, Congress has no authority over private coinage at all and neither does any other branch.” The book “Rethinking Or Centralized Monetary System: the Case for Local Currencies” by Lewis Solomon, professor of legal research at George Washington University, details legal precedent. Here is a sample letter to be signed by a congressmember from the Ithaca area. It can be sent to any official who threatens free trade.

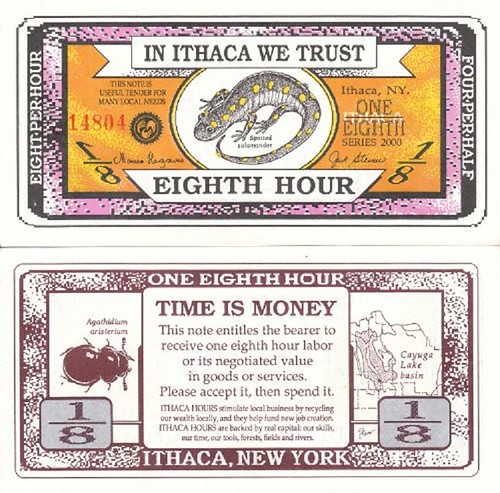

Dear _____________, We understand that you have considered drafting a law that could prohibit all private monies, believing that, like Liberty Dollars, they challenge the primacy of Federal Reserve Notes. I’d like to offer certain distinctions between Liberty Dollars and various community credit systems with which I am familiar. Liberty Dollars confronted the United States seignorage privilege by minting gold and silver coins, using the same mottos, declaring these dollars, and seeking to replace the United States dollar nationwide. Within my district (NY-26), by contrast, we have seen significant economic benefits by trading Ithaca HOURS. This taxable paper currency, valued at $10/hour of basic labor, has facilitated millions of dollars of trade among thousands of individuals and over 500 businesses. The stability of a national currency depends ultimately on the vitality of village and neighborhood economies. Therefore, HOURS strengthen the United States dollar by bringing into productive use many local skills and much time that is not employed by the formal economy. And by so doing the network serves as an incubator for new businesses and jobs. Moreover, this supplemental currency has created discretionary income that has stimulated further millions worth of taxable transaction in the retail economy. Ithaca HOURS, in six denominations, look entirely distinct from Federal Reserve Notes. This colorful cash features local children, waterfalls, trolley cars. Issuede within a 20-mile radius, they serve as a local boost to dollar trade, not a national replacement. Among their advocates are the Tompkins County Chamber of Commerce. HOURS have been reviewed favorably by the Wall Street Journal, Forbes, Business Roundtable, and the newsletter of the Federal Reserve Board of Cleveland. The public voice of HOURS for several years was a former economics professor and Federal Reserve researcher, who managed accounts for the International Monetary Fund. There are many other types of supplemental credits circulating in our country. Disney Dollars transact in the Magic Kingdom. Thousands of merchants nationwide issue promotional store notes, and many downtown districts issue Downtown Dollars. There are vairous online credit systems like LETS (Local Economic Trading System) and ITEK business-to-business credits, whose transactions may be accessed by the IR for taxation. They are mere modest mortar reinforcing the brick walls of capital. Indeed, their aim is not to replace dollars, but to replace lack of dollars. Such currencies are approved in many other countries worldwide, from Germany and France and Britain, to Thailand, Argentina and even the People’s Republic of China. The Swiss trade nearly $2 billion of WIR yearly, among 60,000 businesses. Multinational corporations exchange promissory notes for multimillion-dollar-value barters. An estimated half of global commerce is cashless. Our Federal government’s greater concern should be taxability. I believe that if swapping printed jelly beans adds to federal revenue we should not restrain that trade.

Yours,

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|