PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

BOND PRICES AND EARLY AMERICAN FINANCE

Joe Esposito passed along this article on bonds and the early Republic from the Journal of the American Revolution. Thanks.

Here's a short excerpt. -Editor

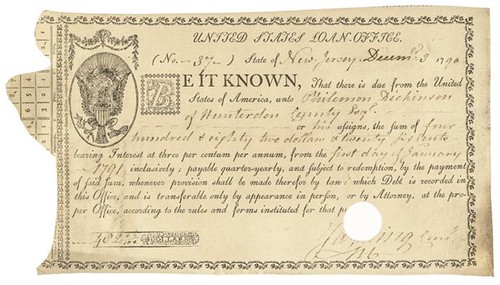

U.S. Loan Office bond issued in 1790, paying 3 percent interest. America’s early finances were, in a word, messy. The states took on enormous debt to fund the Revolutionary War while the national government chartered by the Articles of Confederation issued bonds, took out foreign loans, and even benefitted from personal gifts, all while it had no power to collect taxes. “It was the price of liberty,” Hamilton wrote in his First Report on the Public Credit in 1790. That same report addressed the nation’s credit—during the 1780s, state debt traded at a significant discount to par, as low as $10, or ten percent their original value (a bond’s face value is $100), implying that investors generally didn’t expect to be paid back. Add to that the significant inflation that the nation suffered, and government bonds were certainly not a good investment. Hamilton and the new Congress realized that strong credit was essential for the government to be able to borrow on good terms in times of war and for investment projects in their capital-scarce country. With the advent of the 1787 Constitution and Hamilton’s plan for the federal government to take on states’ unpaid obligations, it seemed governments at both levels would be on surer footing. As the new government began operations, how did these financial reforms play out? Today, U.S. government bonds are the safest available, the “risk-free” asset that influences interest rates around the world. But the 1780s and 1790s were a crucial period for U.S. debt, which, as the data bears out, established the nation’s credit and future success. In Hamilton’s words, a given speculator “paid what the commodity was worth in the market, and took the risks of reimbursement upon himself.” Bond prices ought to reflect investor sentiment towards the debt obligations of the federal government, including how likely it was the U.S. was to pay off debt as it came due. Data compiled by Sylla, Wilson, and Wright include prices recorded for a variety of securities in U.S. financial markets from 1790 to 1860, including U.S. bonds. Examining the movements in the prices of these bonds, we can see how the nation built its early credit. To read the complete article, see:

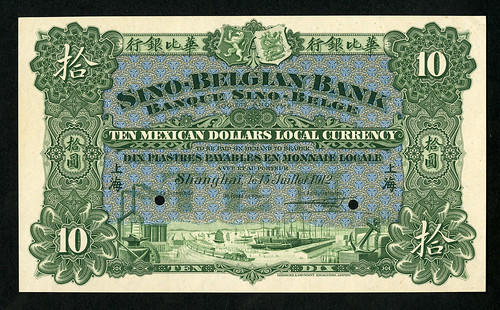

Archives International Auctions, Sale 35 Chinese, Asian & Worldwide Banknotes, Chinese Scripophily, Coins and Security Printing Ephemera September 26, 2016

Click the links! Highlights include: Lot 49: Lot 49 British North Borneo Company Lot 74: Ming Dynasty Circulating Note Lot 172: Lot 172 Russo-Asiatic Bank, 1913-1917 Lot 174: Sino-Belgian Bank, 1908-1912 Mexican Dollar Lot 272: Banco Nacional 1899 Provisional Issues Lot 307: National Bank of the Danish West Indies 1905 Specimen Lot 356: Ethiopia 500 Thalers 1932 High Grade rarity View the Virtual Catalog Download the Catalog in PDF format ARCHIVES INTERNATIONAL AUCTIONS, LLC 1580 Lemoine Avenue, Suite #7 Fort Lee, NJ 07024 Phone: 201-944-4800 Email: info@archivesinternational.com WWW.ARCHIVESINTERNATIONAL.COM Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|