PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

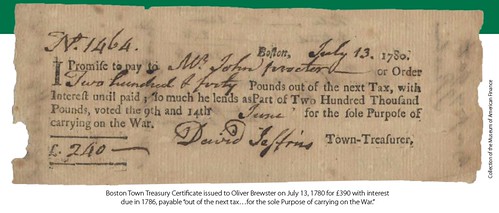

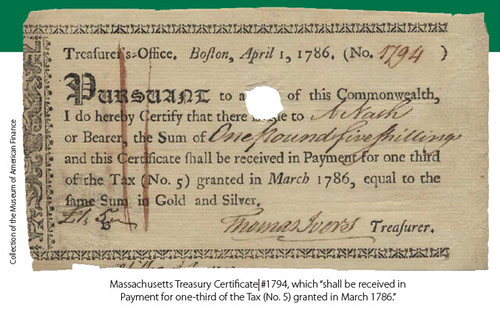

ARTICLE FEATURES COLONIAL FISCAL PAPERThe Summer 2017 issue of Financial History (published by the Museum of American Finance) includes a nicely illustrated article on Public Finance in America, 1607–1861. The

text is all about the economics of colonial taxation, but the illustrations are of financial instruments of the day. -Editor

The taxes on colonial trade raised revenue that funded most of the routine costs of governmental administration in the American colonies and helped finance the loans that the British floated to fight its colonial wars. The taxes also served as a means for regulating economic activity according to mercantilist principles. The current consensus of historians is that this regulatory taxation proved only moderately burdensome to the colonial economy. Moreover, powerful commercial and agricultural elites in the colonies understood that the benefits of membership in the empire, especially naval power exerted on behalf of trade expansion, outweighed the costs of the mercantile system that penalized trade with other empires and nations.  The fiscal transitions between the end of the Revolution and the early 1790s seemed prolonged and painful at the time, but the new nation actually created its modern fiscal state rather quickly. This was primarily because America’s financial leaders, especially Secretary of the Treasury Alexander Hamilton and Robert Morris, had acquired intimate familiarity with the British fiscal state. The most dramatic and influential steps came with the enactment of Hamilton’s financial program during the first administration of President George Washington. Hamilton and the other architects of the fiscal state made taxation its lynchpin. As in Britain, taxes would fund important national projects directly and also pay the interest required to support national debt. Also as in Britain, national taxation would draw most heavily on customs duties. Hamilton intended that the central government would keep the duties at relatively low levels by spreading the costs of the federal government, primarily the management of the federal debt, over a broad base of taxation. The new American fiscal state was a worthy successor to the British fiscal state. Moderate tariffs, helped by generally strong economic growth and dynamic exports, paid off the national debt, including the money borrowed by President Thomas Jefferson to fund the Louisiana Purchase. In addition, the tariff revenues, supplemented at times by excises and special property taxes, funded the military expenses of the republic. For more information on the Museum of American Finance, see:  Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|