PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

RETAINING EQUITY IN NUMISMATICSHere's a non-numismatic item which could make for an interesting thought experiment in the numismatic market. -Editor

For instance, a 10% equity stake in Rauschenberg’s work State—sold in 1959 for $300—would have become $44,000 in the art market. The same $30 investment in the S&P 500 would have returned $2,417 over the same time period. Whitaker acknowledges the results are buoyed by the meteoric success of the artists in the study, but indicated the outsize returns show why shared value matters. “It’s necessary to have a conversation about artists being modeled as investors, whether they become as successful as Johns and Rauschenberg or not. Something to think about. Coin artists are generally government employees or contractors, and not owners in their work. Modern sculptor-engravers have the opportunity to cash in

on their work in other ways, such as selling autographs or lining up deals with marketers. At least that gives them a means to supplement their retirement. But the big gains in the numismatic market

come long after the artists are dead. Had the engravers of the past set aside 10% of their salary in choice uncirculated examples of their coinage these could be worth millions today, but would be a

boon only to their distant descendants.

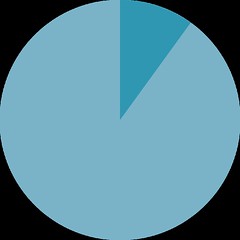

As a collector, retaining equity is one way past the dilemma of seller's remorse. You still own a piece of that favorite piece, and its value continues to rise or fall with the market. At some later date you could sell that share. A bookkeeping nightmare, but we have computers to handle that nowadays, just like the systems tracking royalty payments for music artists. Dealers today often pool their funds and share risk by buying major rarities together, each having their own equity share. This model would allow those equity stakes to live beyond the next sale to all future sales. Financial engineering in numismatics and elsewhere can often end badly. The overhead and potential for swidling can more than eat up the desired benefits. But it's still a fun thought experiment for anyone who's watched something he once sold resell for multiples of the earlier price. -Editor To read the complete article, see:  Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|