PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

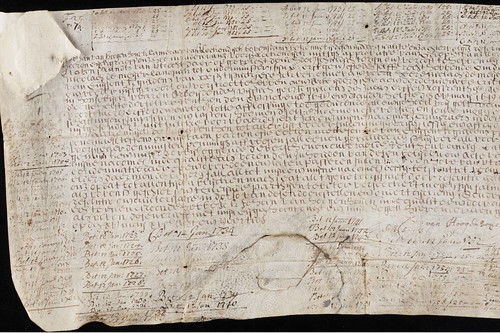

THE BOND THAT STILL PAYS, 280 YEARS LATERA French government bond researched by E-Sylum contributor François Velde is featured in a Wall Street Journal article this weekend. -Editor The French government has owed Marie Verrier's family money for a long time. Almost 300 years. All Ms. Verrier and her husband, Jean, have to do to claim the world's oldest government debt is prove they are the descendants of an obscure 18th-century lawyer. The question is whether it's worth the effort: Three centuries of inflation and shifting currencies mean this debt yields just €1.20 a year, the modern-day equivalent of the long-defunct livres the bond was issued in. "That [yield] would allow you to buy a baguette of bread once a year," said the 81-year-old Mr. Verrier from the couple's home in the Parisian suburb of Asnières-sur-Seine. Bonds that never mature, or do so after a century or longer, aren't just museum pieces. The ultralow interest rates of the last decade have encouraged governments and corporations to borrow for increasingly long periods, with some even selling 100-year bonds now. In some cases, long bonds have become collectors' items worth more than the would-be payout. Dealers in such bond certificates say that prices collectors pay for ultralong bond certificates could go for up to $5,000, depending on their age, rarity and historic importance. Bob Kerstein, founder of dealership Scripophily.com, said he recently sold for about $700 a New Jersey Junction Railroad company bond from 1886 which was signed by the financier J.P. Morgan. Scripophily is the name of the hobby that includes old bond and stock certificates.  World's oldest bond still paying interest In 2003, Yale University acquired the world's oldest debt still being honored: a 1648 corporate Dutch water authority bond written on goatskin. "Such bonds are like a postcard from a different time," said Geert Rouwenhorst, professor of corporate finance at Yale, who as part of a scholarly endeavor collected the payment, which runs at €11.35 a year, from the Dutch water board several years ago. Because it was a bearer bond, where the debt is owed to whoever carries it, Mr. Rouwenhorst had to fly to Amsterdam and hold the strip of goatskin to receive the interest, collecting 26 years of back payments while there. The Verriers don't physically own the 280-year-old bond known as the "Linotte rente," named after Claude-Henri Linotte, a 18th-century lawyer. Rather, they have a chest stuffed with letters and documents showing how their family descends from Linotte-and why they could potentially lay claim to the world's oldest government debt. The Linotte rente has endured five French republics, two world wars and persistent, if unsuccessful, attempts by the French government to get rid of it. An economist at the Federal Reserve Bank of Chicago, François Velde, unearthed the debt during research in Paris in the 1990s and alerted the Verriers. To read the complete article (subscription required), see:  Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|