PREV ARTICLE

FULL ISSUE

PREV FULL ISSUE

LOOSE CHANGE: APRIL 14, 2019Here are some additional items I came across in the media this week that may be of interest. -Editor Book Bound in Wood From Roman Times

For the bibliophiles, here's a story about an interesting book bound in wood dating back to the era of Emperor Hadrian. -Editor

The work itself is illustrated with plates and maps, but it is the binding of this copy that marks it out. It is "formed of wood used in the foundations of the Roman Bridge built over the Tyne at Newcastle… by the Emperor Hadrian, AD120 and was made for Collingwood Bruce at Alnwick Castle." To read the complete article, see:

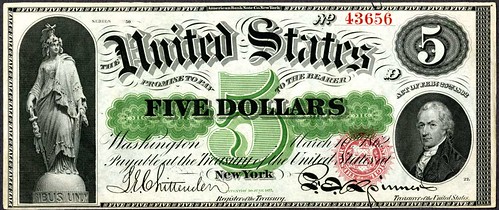

How the Greenback Came About

Howard Daniel forwarded this April 1, 2019 Washington Post article for kids highlighting the first "greenback". Thanks. -Editor  In 1861, Congress needed to find a practical way - a currency that didn't rely on gold or silver - to pay for the Civil War and its soldiers. So the United States was introduced to the first government-regulated paper bills, also called "demand notes." Many would think the $1 would be the first paper bill, but the first bills were the $5, $10 and $20. The bills were also called "greenbacks," a name Civil War soldiers came up with. The color - used to print the back of the bill - had a purpose. To prevent people from counterfeiting, or printing fake money, the government turned to science. "What chemists were looking for was a way to create an ink that could not be erased," Noll said. "And so one chemist in the 1840s came up with this ink that couldn't be removed and has a special chemical layer. It happened to be green." To read the complete article, see:

Revisiting the Dutch Tulip Craze

The numismatic market follows natural cycles, including notable booms and busts. The 1630s Dutch financial craze for tulip bulbs is sometimes cited by numismatic investment writers as an example of a classic boom and bust. Nick Graver forwarded this article which takes a fresh look at the historical evidence. Thanks. -Editor

Why this lasting fixation on tulip mania? It certainly makes an exciting story, one that has become a byword for insanity in the markets. The same aspects of it are constantly repeated, whether by casual tweeters or in widely read economics textbooks by luminaries such as John Kenneth Galbraith. Tulip mania was irrational, the story goes. Tulip mania was a frenzy. Everyone in the Netherlands was involved, from chimney-sweeps to aristocrats. The same tulip bulb, or rather tulip future, was traded sometimes 10 times a day. No one wanted the bulbs, only the profits - it was a phenomenon of pure greed. Tulips were sold for crazy prices - the price of houses - and fortunes were won and lost. It was the foolishness of newcomers to the market that set off the crash in February 1637. Desperate bankrupts threw themselves in canals. The government finally stepped in and ceased the trade, but not before the economy of Holland was ruined. Yes, it makes an exciting story. The trouble is, most of it is untrue. To read the complete article, see:

On Modern Monetary Theory

This article from the American Institute for Economic Research references the article from Stephen Mihm that we discussed a few weeks ago. -Editor Historian Stephen Mihm recently argued that based on his reading of the monetary system of colonial Massachusetts, modern monetary theory (MMT), which he cheekily referred to as PMT (Puritan monetary theory), "worked - up to a point." One can forgive him for misunderstanding America's colonial monetary system, which was so much more complex than our current arrangements that scholars are still fighting over some basic details. Clearly, though, America's colonial monetary experience exposes the fallacy at the heart of MMT (which might be better called postmodern monetary theory): the best monetary policy for the government is not necessarily the best monetary policy for the economy. As Samuel Sewall noted in his diary, "I was at the making of the first Bills of Credit in the year 1690: they were not Made for want of Money, but for want of Money in the Treasury." While true that colonial governments controlled the money supply by directly issuing (or lending) and then retiring pieces of paper, their macroeconomic track record was abysmal, except when they carefully obeyed the market signals created by sterling exchange rates and the price of gold and silver in terms of paper money. MMT in the colonial period often led to periods of ruinous inflation and, less well-understood, revolution-inducing deflation. To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|