PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

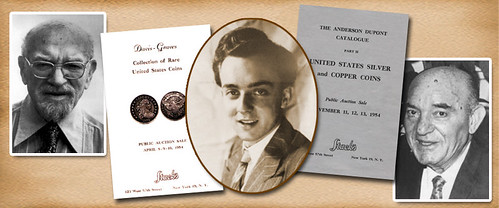

HARVEY STACK'S NUMISMATIC FAMILY, PART 43Harvey Stack's blog series focuses on living in a numismatic family. Here is part 43. Thanks, Harvey. -Editor

My story from last week ended with our finally receiving an explanation of the formula that the government was using to determine what gold coins were worthy of getting a license to import. With this explanation we became confident that we could win our case claiming that their actions were arbitrary and capricious. According to our attorney, "laws can be made and enforced if they are fair and without prejudice" when an action was taken. While the source being used in the government's formula, Gold Coins of the World, was a wonderful reference to learn about coins, it only provided basic information as to what designs were struck and what denominations were issued. It did not consider rare dates within series or the quality of coins. Those who were ruling on what could or could not be licensed for import did not possess knowledge beyond this book and did not have access to the sources that a numismatist would use when assembling a collection. Let me give you an example, using just one denomination: $20 double eagles. Gold in the 1960s was pegged at $35/ounce and traded in that range worldwide. The gold content for the Saint-Gaudens $20 gold, issued from 1908 to 1933, was slightly less than one ounce, but to make this explanation easier, I will call it a full ounce of pure gold. Regardless of date or grade, as precious metal a double eagle was worth $35. If you considered all the dates and mints that struck these coins as one category, the Friedberg book gave the design a value, in average condition of $75. As this did not meet the 4x factor, common $20 double eagles would not be considered worthy of receiving an import license. But, if among the dates were rarities such as 1921, 1925-S, 1926-S, 1926-D, 1927-S, 1927-D, 1929, 1931 or 1932 (all rare and unusual issues, even back in the 1960s), they would all have been treated as common, and considered too low in value to receive an import license. The Custom House, Treasury Department or the Mint considered each and every one of these rare coins as if they were of the common grade, for they were listed in Gold Coins of the World book at the low price of $75. Our case against the Office of Gold and Silver Operations (OSGO) was not claiming that the agents were unable to distinguish a genuine double eagle (or other gold coin) from a counterfeit – the reason the import restrictions were originally instituted. Our claim was that they were not able to determine from the sources they were using what was rare and collectible. By using this argument and citing one coin after another, we were able to demonstrate that the officials were arbitrary and capricious in executing the export licenses. Ironically (although we did not bring this up in the suit as it might make importing even harder), by limiting the import licenses, the government was creating a false rarity for common date coins, as they became scarcer in the United States. This in effect increased the prices for these coins, raising their values over the 4x criteria that the import licenses were based on. The government, once shown that they were creating an unwarranted hardship, asked for and received a stay of opinion, so they could study what they had learned. The Judge extended them that privilege. Sometime in November 1966, we were advised by the Hearing Judge, that we had provided the proper information to the Treasury, and that they should proceed to review our explanation and testimony and permit the licensing we were requesting. We had won our case and waited for the licenses to be issued. However, later in that same month, our attorney was advised that the government had reviewed the Hearing Judge's decision, but then stated: "We received and re-examined the ruling set forth by the Hearing Judge, but not adhering to his ruling, we hereby still deny the license requested." Our attorney was shocked, but noted that he had previously witnessed situations where government agencies did not follow a ruling set forth. The remedy was for us to take the matter to a higher court and start over again. After the Stack family discussed it, we decided that we had been taken advantage of and requested that our attorney file an appeal and take our case to a higher court. It was apparent to us that we were not going to be able to resolve the case in 1966, but we were determined to press on.?

While it veers from numismatics itself into the realm of law and economics, Harvey's story of the legal battle over coin importation is a fascinating look into key issues of the day shaping the numismatic hobby. What an ordeal! -Editor

To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|