PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

THE CASE FOR ELECTRONIC CASHPablo Hoffman of New York City passed along this Technology Review article on cash vs. electronic currencies. Thanks. -Editor

Was it legal? If you'd rather keep all that to yourself, you're in luck. The person in the store (or on the street corner) may remember your face, but as long as you didn't reveal any identifying information, there is nothing that links you to the transaction. This is a feature of physical cash that payment cards and apps do not have: freedom. Called "bearer instruments," banknotes and coins are presumed to be owned by whoever holds them. We can use them to transact with another person without a third party getting in the way. Companies cannot build advertising profiles or credit ratings out of our data, and governments cannot track our spending or our movements. And while a credit card can be declined and a check mislaid, handing over money works every time, instantly.

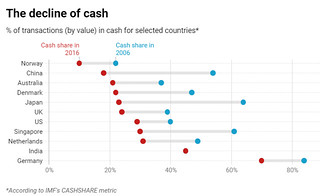

This trend has civil liberties groups worried. Without cash, there is "no chance for the kind of dignity-preserving privacy that undergirds an open society," writes Jerry Brito, executive director of Coin Center, a policy advocacy group based in Washington, DC. In a recent report, Brito contends that we must "develop and foster electronic cash" that is as private as physical cash and doesn't require permission to use. The central question is who will develop and control the electronic payment systems of the future. Most of the existing ones, like Alipay, Zelle, PayPal, Venmo, and Kenya's M-Pesa, are run by private firms. Afraid of leaving payments solely in their hands, many governments are looking to develop some sort of electronic stand-in for notes and coins. Meanwhile, advocates of stateless, ownerless cryptocurrencies like Bitcoin say they're the only solution as surveillance-proof as cash—but can they be feasible at large scales? We tend to take it for granted that new technologies work better than old ones—safer, faster, more accurate, more efficient, more convenient. Purists may extol the virtues of vinyl records, but nobody can dispute that a digital music collection is easier to carry and sounds almost exactly as good. Cash is a paradox—a technology thousands of years old that may just prove impossible to re-create in a more advanced form. To read the complete article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|