PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

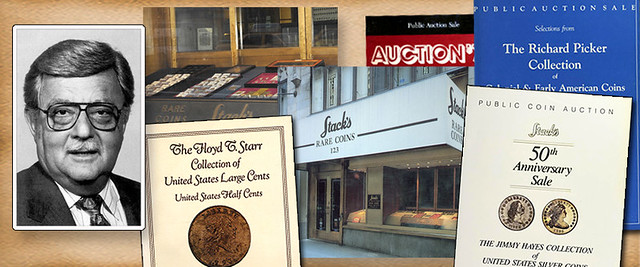

HARVEY STACK'S NUMISMATIC FAMILY, PART 96The latest article in Harvey Stack's blog series opens the year 1985 with the creation of PCGS and NGC, and the Salomon Brothers numismatic market index. -Editor 1985 was another major year for the numismatic hobby, as it changed and adopted some new guidelines, moved by collector and dealer activity. First of all, the markets for precious metals, especially silver, calmed down, recovering from the speculation precipitated by the Hunt Brothers at the beginning of the decade. Collectors had come back to the market as silver prices returned to their pre-speculation prices.

The hobby was finding more ways to deal with the ongoing problems of counterfeiting and inconsistent grading. The American Numismatic Association had earlier launched ANACS, which provided authentication for items as well as grading opinions. In addition, they had published a set of grading standards that could be used across numismatics. However, the certificates that ANACS issued to the owners of the pieces they authenticated and/or graded were in no way In 1985 a group of coin experts got together to try to build a more dependable way for coins to be graded. This new company, Professional Coin Grading Services (PCGS), would begin accepting submissions in 1986, and would be followed not long after by the Numismatic Guaranty Corporation (NGC). These new companies would change numismatics forever and move the hobby even more from adjectival to numerical grading. By encasing coins in plastic holders with information and a grade imprinted on the sealed slab, they found a way to be sure that the grading opinion and authenticity guaranty would remain attached to the correct coin. These services would turn out to be quite efficient and provide collectors with greater confidence in the items they were purchasing. On another front, the stock brokerage house Salomon Brothers got interested in learning more about various collectible markets. They engaged some expert firms in providing a market index for collectibles that was published for 11 years, starting in the early 1980s. Stack's was asked to develop a portfolio and submit any growth or drop in value that occurred each year. Norman and I, who were the major partners during that time, accepted the proposal, and we decided to create a type set with about 20 coins at its core to use for this purpose. We selected a date and grade to represent the type, without revealing this information to anyone. We researched each type and then added up its value at the end of each year, submitting our results to Salomon Brothers to be included in their annual index. They thought this would be a valuable and needed service for many of their clients who had ventured into the tangible markets. Among the items covered in their index were: Stocks. Bonds, Gold, Silver, Classical Art, Antiques. Coins, Stamps, and even Chinese Porcelain. It was a pleasant surprise to us and the coin industry that for eight of the 11 years this index was published, the coins that Stack's selected led the growth market. In the other years, coins were in the top three areas in the index. We felt that the type and rarity of the pieces we had selected, as well as keeping the contents secret, provided an accurate growth indication -- the information Salomon Brothers wanted to reflect.

However, due to a revelation by a staff member at Salomon Brothers, the contents of the portfolio was revealed. We felt that they had compromised the secrecy of the portfolio and the value that provided, and we asked to have our yearly contribution to the index removed. We were concerned that if the contents of the portfolio were known, certain promoters and dealers might misuse the information and try to accumulate and hoard those pieces and manipulate the results. Salomon Brothers agreed that this could happen in the field of rare coins and thanked us for our contributions. At Stack's, we felt that this

To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|