PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

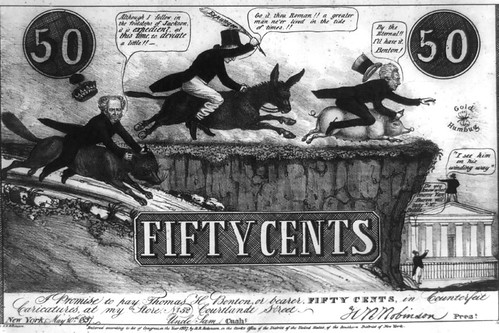

STABLECOINS AND THE WILD WEST OF FINANCEGerry Tebben passed along this Wall Street Journal article about Bitcoin and banking before the Civil War. Thanks! Here's Gerry's comment. and an excerpt from the article. -Editor Gerry writes: "I don't understand cyber currencies. I don't even understand the possibility of understanding them. They seem more theology than economics to me. But there is something called a Stablecoin that tries to bridge the unfathomable gap between the etherial currencies and greenbacks. The article tries to explain it. I understand antebellum banking, but don't understand why anyone would want to go back to it." Stablecoins are one of the weirdest things in the whole bizarro world of cryptocurrencies, because they operate on principles directly opposed to the rest of the crypto system. Stablecoins are a type of cryptocurrency tied one-for-one to dollars or other traditional currencies and whose value relies on trusting the issuer. Stablecoins have also become central to the financial infrastructure of crypto. According to data provider Crypto Compare there's more trading between Tether and bitcoin than between bitcoin and all fiat currencies put together. For crypto traders, at least, stablecoins are a vital tool, because of the speed with which they can be used to move money from one crypto exchange to another, and because they provide a handy way to park cash temporarily in what is basically dollars. This creates a major vulnerability for crypto. Instead of building a new financial system immune to the problems of the old one, it is reinventing problems long-since mitigated by regulators in traditional finance. To understand this weakness, a quick history lesson. Stablecoins are the living embodiment of free banking, the system of lightly-regulated and often fraudulent issuers of dollar bank notes that dominated U.S. finance until the government stepped in after the Civil War. Paper money was backed by the assets of these banks. But trust in those assets determined whether and how big a discount to apply to any given dollar bill. Alongside the regulated banks were thousands of issuers of small-value IOUs, such as from a Michigan barber, that were used as money in frontier towns short of cash. There's a good reason these stablecoins of yore were eventually junked. Users of money—that is, pretty much everyone—had to keep up-to-date on the condition, and perceived condition, of dozens of bank note issuers to avoid being duped on a transaction. The costs of this alone were incalculable, quite aside from the widespread failures and fraud. The twin dangers to the scores of stablecoins that have been created are the same as the pre-Civil War scrip: the assets turn out to be worth less than thought, or people come to believe that the assets are worth less than thought and there's a run. The biggest stablecoins—from Tether, Circle and Paxos—publish reports from accountants attesting that their assets match the amount issued, in an attempt to ensure trust. So far, all three have succeeded, with their stablecoins proving remarkably stable around $1.

A glance at the free banking era should remind traders of the risks. Back in the 1830s, banks would fool auditors by shipping the same chest of coins from one to the next to be counted multiple times, or by topping up a barrel of nails with a layer of silver, according to Joshua Greenberg's enjoyable study of the era, The parallel is clear from the details of Tether's $18.5 million settlement with the New York Attorney General in February. It said Tether was lying about having full backing for its issues, and when Tether tried to head off rumors about its financial situation by employing an accountant to attest to the assets, cash was put into its new account only on the day of the assessment. Tether also lent $475 million to work with Bitfinex to help it through a cash crunch, this time the day after publishing the balance of a new bank account in the Bahamas. This is the modern version of mobile chests of silver. It surprises me that Tether is so popular given the revelations from the New York case, the ease with which it can suspend payments and the concern among regulators, including the Fed, about stablecoins. But there is a key difference to the earlier era that helps stablecoins avoid the discounts that plagued the bank notes of the Wild West. Back then the effort of traveling to a bank's branch to swap its notes for solid silver dollars meant it was hard to arbitrage away discounts, especially for notes from faraway banks. In the digital world it isn't much of a hassle to cash in a stablecoin, so any discount quickly vanishes. At least so long as the stablecoin issuer has ready money to pay back claims.

To read the complete article (subscription required), see:

THE BOOK BAZARREWayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|