PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

V25 2022 INDEX E-SYLUM ARCHIVE NNP ADDS TREASURY DEPARTMENT PRESS RELEASESThe latest addition to the Newman Numismatic Portal is a collection of Treasury Department press releases. Project Coordinator Len Augsburger provided the following report. Thanks. -Editor Gold Coin Circulation in 1917

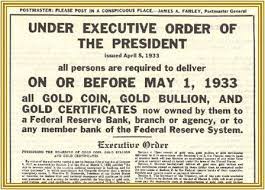

Although not withdrawn until 1933, the Treasury Department discouraged use of gold coin as early as 1917. A December 2, 1917 press release recently added to Newman Portal outlined the talking points. Secretary W. G. McAdoo noted that circulation of gold coin caused Thanks to Roger Burdette for pointing out the collection of Treasury Department press releases available at FRASER, the online Federal Reserve Library. Image: Executive Order 6102, demanding surrender of gold coin, bullion, and certificates.

Link to Statement by Secretary McAdoo on Use of Gold Coin as Circulating Medium:

Link to Treasury Department press releases on FRASER:

Roger adds: "This also led to Treasury encouraging Western state citizens to turn in badly worn gold coins in exchange for Federal Reserve Notes. Normally, the worn coins would have been accepted only at bullion weight, which was often several dollars below face value. It cost Treasury over $100k to buy the worn coins." Here's an excerpt from Roger's 2018 book Saint-Gaudens Double Eagles (p268-269). -Editor

"Before the war, U.S. mints had engaged in gratuitous re-coinage. Lightweight coins were separated from standard pieces, and melted, then struck into new coins of full weight. The Mint Bureau reported the difference between actual gold content and face value as a loss, and it was treated as a necessary obligation required to maintain integrity of the coinage. As noted above, exchange rates between San Francisco and New York tended to pull new gold coins out of circulation for shipment east, leaving only the worn coins for local use. "With Pacific coast gold coins not being replaced, their actual metallic value declined due to abrasion. The treasury decided in February 1917 to redeem any gold coins presented by banks and individuals at face value for the limited period of ninety days. (Unofficially, the redemption period was nearly a year.) The government would absorb the loss and pay for the redemption in Federal Reserve Notes. Opponents felt the cost would be too high, while proponents argued it gave owners of worn coin fair value, and also helped the country by adding gold to the national reserves.

"Assistant United States Treasurer in San Francisco, William J. McGee, was quoted as stating the plan would cost about $100,000. [source of $100k estimate --

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|