PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

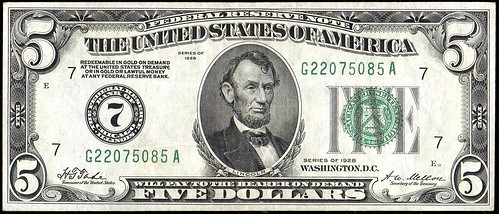

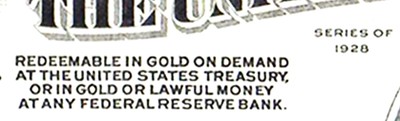

V25 2022 INDEX E-SYLUM ARCHIVE FEDERAL RESERVE NOTE GOLD BACKINGWayne Pearson submitted these notes on the redeemability of Federal Reserve Notes in gold. Thanks. -Editor Once upon a time, in 1929, Federal Reserve Notes (1928 series) were backed by gold. In this $5 example, read what it says on the upper left. Now look at a 1934 $5 FRN. After FDR outlawed gold, you can see the difference in the writing. For more background on Federal Reserve Notes, Wayne passed along this Investopedia article. Thanks. -Editor Federal Reserve notes were first issued after the creation of the Federal Reserve System (FRS) in 1913. Before 1971, any Federal Reserve note issued was theoretically backed by a legally specified amount of gold held by the U.S. Treasury, though since 1933 private citizens were not allowed to actually redeem them for gold dollars. Because these notes held legal tender status and represented actual dollars (legally specified as a given quantity of gold held by the Treasury), they came to commonly be referred to as "dollar bills" as they circulated through the economy. However, under President Nixon, the last vestige of the gold standard was officially abandoned, creating a fully fiat currency, where the Federal Reserve notes themselves became the sole circulating legal tender (along with small base-metal coins), redeemable only for other Federal Reserve notes and not for physical dollars. Federal Reserve notes are not backed by hard assets. Instead, Federal Reserve notes are now backed solely by the government's declaration that such paper money was legal tender in the United States, or by fiat. Today, Federal Reserve notes circulate as money throughout the U.S. and the rest of the world wherever dollar-denominated transactions take place. These notes are still commonly referred to as "dollars," which was previously a legally defined quantity of gold or silver but is now simply the official unit of account for U.S. legal tender, including Federal Reserve notes. The U.S. Treasury prints the Federal Reserve notes at the instruction of the Board of Governors and the twelve Federal Reserve member banks. These banks also act as the clearinghouse for local banks that need to increase or reduce their supply of cash on hand. Once new Federal Reserve notes are issued, they become a liability of the Federal Reserve, which can be redeemed by bearers on demand for different Federal Reserve notes.

To read the complete article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|