PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

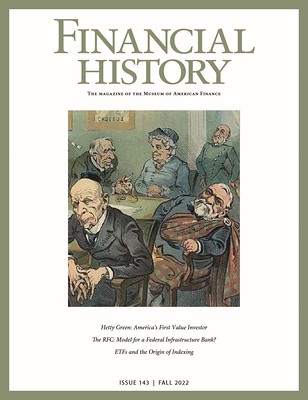

V25 2022 INDEX E-SYLUM ARCHIVE HETTY GREEN, VALUE INVESTORUber-collector Col. E.H.R. "Ned" Green was the son of Hetty Green, once the richest woman in America. Financial History Magazine from the Museum of American Finance has a cover article about her. Here's an excerpt. The illustration is from the July 26, 1905 issue of Puck magazine, where Hetty Green is depicted at the head of the table alongside other turn-of-the-century moguls and financiers including J. P. Morgan, Andrew Carnegie and John D. Rockefeller. -Editor

At the peak of her career, Green was the most creditworthy lender to America's most respected stock operators, corporations and even city governments. Her accomplishments are extraordinary by any standard, but what makes them even more impressive is that she succeeded despite lacking the advantages afforded to men at the time. She could not purchase a seat on the New York Stock Exchange, serve as a director on a corporate board or even exercise the right to vote.

Henrietta Hetty showed a keen interest in mathematics and finance as a child. Her interest blossomed when Gideon's failing vision prevented him from reading financial documents and newspaper reports relating to the family business. Each day, Hetty read them aloud to Gideon, and she later credited much of her business education to these daily sessions. Gideon passed away when Hetty was 13, at which point Hetty's perfect eyesight and burgeoning financial acumen attracted her father's attention. She immediately became her father's eyes, while also learning the practical elements of business management by shadowing him on his daily visits to the New Bedford docks. By the time Hetty turned 15, her financial acumen rivaled that of her father. Hetty's father exited the whaling business and relocated to New York City. Hetty spent the next six years shuttling between New York and New Bedford. While residing in New York, she met her future husband, Edward Henry Green, who had amassed a substantial fortune of his own. Her father encouraged the marriage, as he was worried about Hetty's ability to manage the family business independently when he was gone. In May 1865, Hetty and Edward announced their engagement, and they were married two years later. Soon after her engagement, Hetty's father and Aunt Sylvia passed away. Although Hetty was the primary beneficiary on both estates, most of the assets were placed into trust, entitling Hetty only to the income. This enraged Hetty because she knew she could invest the assets more effectively and at much lower cost. She was especially angered by Sylvia's will, and she initiated a drawn-out court case disputing its legitimacy. Throughout Hetty Green's life, journalists portrayed her as a cruel miser. Like all people, Hetty was imperfect, but her transgressions paled in comparison to most Gilded Age financiers and stock operators. She made most of her money providing capital at reasonable interest rates. In fact, during many panics, she offered capital at below market rates. Outside of her business dealings, Hetty was also a caretaker. There are countless stories of her caring for sick neighbors, and she also played the role of Good Samaritan to complete strangers. For example, while residing in London, she bandaged a delivery man who had fallen from his carriage, while onlookers seemed content to watch him bleed out. Hetty Green passed away on July 3, 1916. Almost her entire estate, which was valued at more than $100 million, was split evenly between her two children, Ned Green and Sylvia Ann Wilks. Neither of her children had heirs, and upon their passing, Hetty's wealth was distributed to 63 different charitable organizations.

To read the complete issue on the Newman Numismatic Portal, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|