PREV ARTICLE

FULL ISSUE

PREV FULL ISSUE

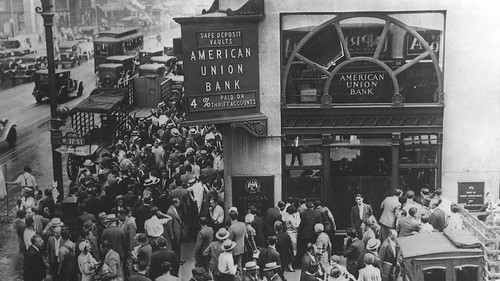

BANK FAILURES: AS AMERICAN AS APPLE PIEOne of my favorite historians, John Steele Gordon, published a lengthy article for American Heritage magazine on the long history of bank failures in the U.S. Here's an excerpt, but be sure to see the complete article online. Very interesting. Found via News & Notes from the Society of Paper Money Collectors (Volume VIII, Number 41, March 28, 2023) -Editor The recent failures of Silicon Valley Bank and Signature Bank were shocking, but shouldn't surprise. Even a quick look at banking history reveals that failures are as American as apple pie. Some 565 banks have closed since 2000, according to the FDIC, and over a thousand saving and loans failed during the crisis of the 1980s and early 1990s.

In 2018, Congress removed bank regulations that were put in place in the wake of the financial crisis of 2007-8. These regulations had required banks to undergo annual Despite the need to maintain an impeccable reputation, bankers are human. They are sometimes too agreeable to their friends, sometimes too optimistic, or too greedy, or dishonest. Once someone possesses the magic power to create money, the temptation to create too much is very strong. That's why banks need constant watching. And never forget that banks are in the money business. That's why Willie Sutton robbed them. That's why politicians want the bankers on their side and are thus predisposed to favor the bankers over the banking system.

Why the dismal record? The two centuries since then have been marked by literally tens of thousands of bank failures in the U.S. In sharp contrast, Great Britain, whence most of American banking theory and practice comes, has had only a handful of major bank failures in over a hundred years. Why should the richest and most productive capitalist economy on earth have such a dismal record in safeguarding a system so central to capitalism? The answer lies in the peculiar nature of the business we call banking, in our national history as a federal republic of sovereign states, and in our politics.

While no one could dispute that our Constitution and our politics have been, on the whole, a triumphant success, American banking is perhaps the ultimate proof of Sir Winston Churchill's contention that Banks are in the money business, and that, ipso facto, makes banking a very peculiar business indeed. Cash on hand, for instance, is an asset in most enterprises; it is usually a liability to a bank because it is owed to the depositors. Loans, on the other hand, are assets because they are owed to the bank. If an ordinary business goes broke, it is a financial problem for the owners, the employees, and the creditors, who, usually being professionals, have no one to blame but themselves. When a bank goes broke, however, it can affect the personal economic well-being of nearly everyone in the community or even, if the bank is large enough, the entire country.

In 1790, when Alexander Hamilton submitted to Congress his In 1980 Congress removed the ceiling on the interest rates that bankers could pay and, while they were at it, raised the amount of the federal guarantee on deposits from forty thousand dollars to one hundred thousand. Had the federal guarantee simply tracked inflation since 1934, the guarantee would have amounted to slightly more than fifteen thousand dollars by 1980. Had it remained at the same multiple of average family income, it would have been slightly less than fifty thousand dollars. Raising it to one hundred thousand was not, therefore, done to protect widows and orphans. It was done to help out the bankers.

To read the complete article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|