PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

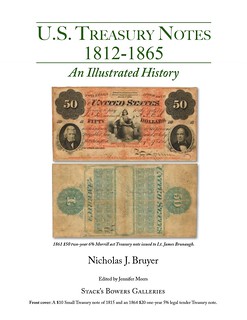

NEW BOOK: U.S. TREASURY NOTES, 1812-1865Stack's Bowers has published a new book by Nicholas J. Bruyer on an important, underappreciated topic, U.S. Treasury Notes. With permission, here are a couple excerpts from the book. I don't have ordering information at this time, however. -Editor

U.S. Treasury Notes, 1812-1865: An Illustrated History

First, here's a section from the Foreword by Stack's Bowers Galleries Director of Currency Peter A. Treglia. -Editor

This isn't just an important reference; it's also written in a concise and enjoyable way that fills a gap in the numismatic library. Tracing these issues from the First Bank of the United States to the War of 1812, the Panics of 1837 and 1857, and Interest Bearing Treasury Notes during the Civil War, Nick's chronicle provides historical context through a good story, solid research, and representative images. This book explains how these banknotes evolved over time, why they were issued, and how they were distributed, alongside a comprehensive summary of the historical events related to their issuance. Among the highlights is extensive research on Treasury ledgers, important figures in politics and finance, different interest types, what the funds were used for, and other fascinating details. Many of the notes illustrated in the book are rare proofs or specimens, some of which were never issued or are unknown in their issued form. In the past, this has resulted in the dearth of general information and available illustrations, but Nick has tackled this daunting project with enthusiasm, integ.rity, and a deep understanding of financial history. Here's a section from the author's Introduction. -Editor

One note in particular jumped out at me – a $50 1861 two-year 6%

Treasury note payable to Received wisdom held that these notes were originally sold at a discount to face value, mostly to banks, and were not used in commerce. Upon researching the mysterious Mr. Brunaugh, I was surprised to learn that he was neither an investor nor a banker, but a U.S. army lieutenant in an Iowa volunteer regiment, whose job as quartermaster was to clothe, arm and feed them. The Treasury Department had issued a packet of these notes in $50 and $100 denominations, undiscounted at full face value, to Lt. Brunaugh for supplies. As I explored the story of these notes in contemporary press accounts I discovered Secretary of the Treasury Salmon P. Chase used them for all manner of payments, from warships to Congressional salaries. Turning next to Donald Kagin's fine book on Treasury notes from the War of 1812, it was clear that Treasury Secretary Alexander Dallas took great, albeit flawed, measures to establish Treasury notes as a circulating medium. Digging deeper into other issues – the Panic of 1837, the Mexican War, the Panic of 1857 – revealed Treasury notes bearing nominal interest (as little as one mill percent) used as money to buy goods and services.

At the nation's most desperate moments – when

federal depositories were emptied, when mountains

of creditor bills piled up for months, when armies in

the field went unpaid, when fearful bankers refused to

loan the government a dime – time and again Congress and the Treasury Department turned to Treasury

notes to rescue their administrations from insolvency.

Some say that an interest-bearing certificate cannot

be money, yet 6% compound interest Treasury notes,

which were the U.S. government's No doubt large amounts of Treasury notes were sold to investors, sometimes at a premium to face value, and were held as investments until maturity. In some instances, such as the two-year Treasury notes of 1847, there is no evidence that any of them were used as money. Yet history amply reveals that secretaries of the Treasury, as well as Congress itself, purposely and repeatedly imbued Treasury notes with features necessary for them to be used commercially as money.

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|