Pablo Hoffman passed along this item from the Delancey Place blog, with an excerpt about the Bank of Virginia from State Banking in Early America by Howard Bodenhorn. Thanks.

-Editor

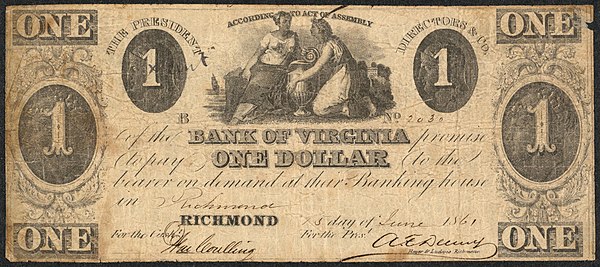

The first major bank in the southern United States was the Bank of Virginia, chartered in 1804. Although the southern politicians among our nation's founding fathers, the so-called Jeffersonian Republicans, were opposed to banks and the granting of any corporate privilege, businessmen in the South came to understand clearly that economic growth would benefit from the establishment of a bank:

Contemporary southerners saw a direct correlation between banking and economic growth. Although several of Virginia's prominent political leaders opposed banking, especially state-sponsored, state-chartered banking, on the grounds that it violated Revolution-era republican ideals by creating a financial oligarchy, popular sentiment overcame political philosophy. In 1791, about $2 million in produce was shipped from Maryland ports; Virginia's exports totaled about $3 million. Within a decade, Maryland's exports increased to $12 million but Virginia's increased to just $4 million. Contemporaries did not attribute Maryland's rapid growth solely to its banks, but they did believe that credit was partly responsible. The time had come for Virginia to enter the age of banking.

Legislative debate on a bank charter invited a legion of merchants and planters in every small town along the James River to make a case for why they deserved a bank. Although the legislature accepted the legitimacy of the credit demands, they were convinced that few such places would support a bank. Torn between competing interest groups--merchants and planters clamoring for credit and Jeffersonian Republicans opposed to any grant of corporate privilege--the legislature chartered a bank they thought capable of meeting legitimate credit demands while allaying the worst fears of its critics. The Bank of Virginia (1804) was a compromise, a model later copied throughout the southern and western United States.

With the exception of the Manhattan Company, the Bank of North America, and the Bank of Pennsylvania, the $1.5 million Bank of Virginia was substantially larger than most banks. The state subscribed one-fifth of its shares with the right to appoint one-fifth of its directors so that it could simultaneously profit from it and exercise a measure of control over it. Having mollified concerns over unfettered corporate privilege, legislators met the widely scattered credit needs by establishing five branches.

To read the complete article, see:

THE BANK OF VIRGINIA -- 7/31/23

(https://www.delanceyplace.com/view-archives.php?p=4911)

Wayne Homren, Editor

The Numismatic Bibliomania Society is a non-profit organization

promoting numismatic literature. See our web site at coinbooks.org.

To submit items for publication in The E-Sylum, write to the Editor

at this address: whomren@gmail.com

To subscribe go to: https://my.binhost.com/lists/listinfo/esylum

Copyright © 1998 - 2024 The Numismatic Bibliomania Society (NBS)

All Rights Reserved.

NBS Home Page

Contact the NBS webmaster

|