PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

ON THE CLOSURE OF THE POBJOY MINTMichael Alexander published an Coin Update article with insightful thoughts on the closure of the Pobjoy Mint. Here's an excerpt - see the complete article online. -Editor

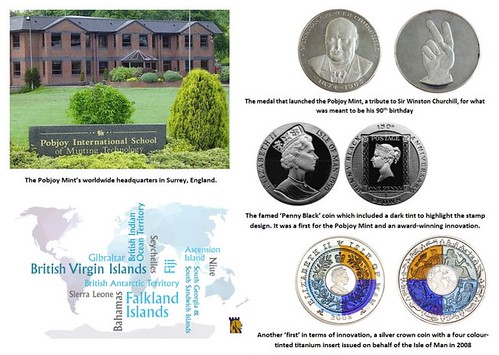

Almost two weeks ago, you likely heard the surprising news of the retirement of the Pobjoy Mint's current director, Taya Pobjoy, and subsequently the closure of the Pobjoy Mint. Anyone who has been an active collector of modern coins during the last half century would probably have at least one or more coins produced from their privately owned facility in Surrey, England; it's virtually impossible not to. With Taya Pobjoy's announcement that she wanted to retire after having been at the helm for over thirty years, few could find fault with the reason. Taya, a wife and mother of two daughters, referenced wanting to spend time with her family and that it was essentially Some suspect that the Pobjoy Mint simply ran out of steam, while others suggest there is too much competition and the collector market is far too saturated with products as it is. Others might rightly point out that Pobjoy Mint may have been the victim of its own success. It seems quite evident that the business model the Pobjoy Mint perfected over the years has since been readily adopted by many other minting facilities, both national and private. This involved the prolific production of gold, silver, and base metal collector coins, purpose-driven marketing campaigns used for many of those coins and mintages to satisfy demand. More importantly, their formula involved securing a variety of issuing authorities to release collector coins on their behalf. Anyone can produce medals in whatever quantity they wished. Still, the release of an actual coin or NCLT (non-circulating legal tender coin) was cultivated by Pobjoy Mint since it first signed a contract with the once-obscure treasury of the Isle of Man in 1970. Today, this is something routinely carried out by the likes of national mints from the Czech Republic, Poland, the Netherlands, and Lithuania, to name but a few. Ultimately, Pobjoy Mint, during its fifty-eight years of production, would go on to strike coins for forty-two different countries and territories. As trends changed and new, more savvy collectors demanded different products and, more importantly, lower prices and mintages, Pobjoy Mint's products moved toward bullion-related coins from kilos, multiple ounces down to a half-gram gold ounce. They became an innovator in minting titanium coins, tinting silver and cupro-nickel crowns and crystal inlays, all of which were acknowledged with many coin awards over the years for innovative approaches to minting and design. Is Pobjoy's closure a case of too much success or too much saturation? Well, it may be a bit of both. Over the last decade, a preference for and supply of bullion-related coins has become paramount for both national and private mints. For the most part, they're far more affordable, they've become more decorative and theme-oriented, and there is often a much smaller premium over the cost of their counterpart precious metal collector coins.

On the day collectors learned about Pobjoy's closure, we also heard the news of the Royal Danish Mint's final announcement of their permanent closure at the end of November. It's no wonder that the coin world is asking which big player or even mid-sized national mint may look to cease operations next — especially as there seems to be an illogical race to create cashless societies. As I referenced earlier, Pobjoy may be the victim of its own success or just another example of a general trend to de-monetise countries, but the saying

To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|