PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

FREIGELD: MONEY THAT EXPIRESIn the Great Depression a number of communities around the U.S. and the world experimented with stamp scrip - notes that required that stamps be affixed for each transaction (or at regular intervals) in order for the scrip to remain valid. This scheme ensured that the notes would continue to circulate like hot potatoes, increasing the velocity of money and benefiting the overall economy. Money of the latter form (expiring without periodic stamping) was promoted by economist Silvio Gesell (1862–1930) and put into practice in 1932. A new article examines Gesell's "Freigelt" and asks whether "society and the economy would be better off if money was a perishable good." Here's a short excerpt, where I've reordered some paragraphs for readability here. See the complete article online for more. Found via News & Notes from the Society of Paper Money Collectors (Volume IX, Number 22, November 14, 2023). See also the articles linked below. -Editor As it evolved, money became increasingly symbolic. Early paper money acted as an IOU and could always be exchanged for metallic coins of various values. In the late 13th century, however, the Mongol emperor Kublai Khan invented paper money that was not backed by anything. It was money because the emperor said it was money. People agreed. In the intervening centuries, money has conjured more fantastic leaps of faith with the invention of the stock market, centralized banking and, recently, cryptocurrencies. More than a century ago, a wild-eyed, vegetarian, free love-promoting German entrepreneur and self-taught economist named Silvio Gesell proposed a radical reformation of the monetary system as we know it. He wanted to make money that decays over time. Our present money, he explained, is an insufficient means of exchange. A man with a pocketful of money does not possess equivalent wealth as a man with a sack of produce, even if the market agrees the produce is worth the money.

In 1898, the Argentine government embarked on a deflationary policy to try to treat its economic ills. As a result, unemployment rose and uncertainty made people hoard their money. The economy ground to a halt. There was plenty of money to go around, Gesell realized. The problem was, it wasn't going around. He argued that the properties of money — its durability and hoardability — impede its circulation: Those who live by their labor suffer from this imbalance. If I go to the market to sell a bushel of cucumbers when the cost of food is falling, a shopper may not buy them, preferring to buy them next week at a lower price. My cucumbers will not last the week, so I am forced to drop my price. A deflationary spiral may ensue.

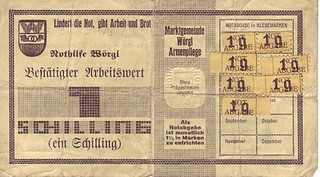

To achieve this, he invented a form of expiring money called Freigeld, or Free Money. (Free because it would be freed from hoarding and interest.) The theory worked like this: A $100 bill of Freigeld would have 52 dated boxes on the back, where the holder must affix a 10-cent stamp every week for the bill to still be worth $100. If you kept the bill for an entire year, you would have to affix 52 stamps to the back of it — at a cost of $5.20 — for the bill to still be worth $100. Thus, the bill would depreciate 5.2% annually at the expense of its holder(s). (The value of and rate at which to apply the stamps could be fine-tuned if necessary.)

Although many dismissed Gesell as an anarchistic heretic, his ideas were embraced by major economists of the day. In his book

To read the complete article, see:

Gesell died in 1930, but that year a group called the Wära Exchange Association was created to put his ideas into practice. -Editor

The experiment at Wörgl was implemented by the town's mayor, Michael Unterguggenberger in the midst of the Great Depression. Wörgl, like many towns throughout the world at the time, was suffering from high unemployment and low economic activity. The experiment began on the 31st of July 1932, with the issuing of "Certified Compensation Bills," a form of currency commonly known as Stamp Scrip, or Freigeld. It resulted in a boom in government projects, and a corresponding increase in employment and economic activity not just in the government sector, but throughout the town. Despite its apparent success, and despite attracting the attention of luminaries such as French Premier Edouard Daladier and the economist Irving Fisher, the "experiment" was terminated by the Austrian National Bank on September 1, 1933.

For more information, see:

To read earlier E-Sylum articles, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|