PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

ALDRICH-VREELAND EMERGENCY CURRENCY OF 1914Peter Huntoon writes: A couple of issues ago you ran a piece contrasting American and British responses to the currency shortage caused by the outbreak of World War I and asked if anyone had anything on the Emergency Currency that was pressed into circulation here. As soon as you see the attached, you'll slap your forehead because it is hiding in plain sight! Perhaps your readers will find this treatise enlightening.

Thanks! Here's an excerpt from Peter's unpublished article. -Editor

A crippling problem with national bank currency was that the supply of money was a fixed percentage of the capitalization of the national banks. Consequently, the volume of notes in circulation did not respond to the varying demands of business cycles. This problem doomed national currency, so the elastic federal reserve currency system was invented to replace it. The concept that emerged is the following. As the demand for money increases, interest rates rise so banks can charge more interest on new national bank notes that they can draw against short term paper deposited as security. If the emergency increase in national bank note circulation is taxed at a higher rate, businesses can afford to pay the higher interest rates and the banks can in turn afford to pay the higher tax. However as business demand for currency falls, interest rates also fall, so the banks will reduce their emergency national bank note supply to avoid the higher tax. THE ALDRICH-VREELAND ACT

The Aldrich-Vreeland Act provided a mechanism that would permit banks to use securities other than U. S. government bonds to obtain short-term increases in their circulations. Two types of entities could apply for the additional currency: (1) groups of at least 10 banks formed into national currency associations and (2) individual banks. National currency associations were authorized to accept securities from a member bank and then to apply to the Comptroller of the Currency for additional circulation for that member bank. The total amount of emergency currency that could be issued under this act was set at $500,000,000. This amount was subsequently raised to over $1 billion by a hastily passed amendment dated August 4, 1914, immediately following the outbreak of World War I in Europe.

DATE BACK NOTES

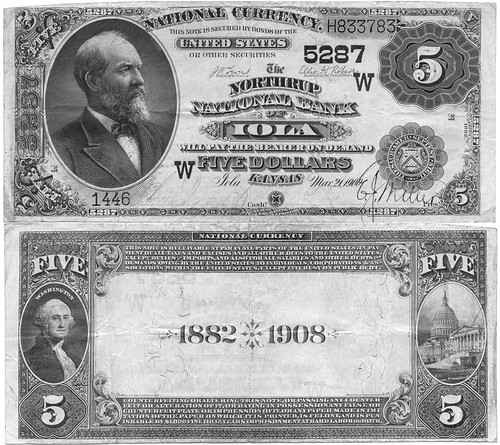

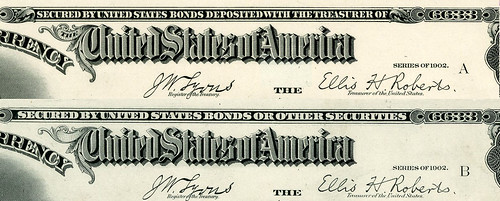

Very significant to numismatists was the fact that the Aldrich-Vreeland notes heralded the date back designs, most importantly causing the demise of our colorful Series of 1882 brown backs. The Secretary of the Treasury George B. Cortelyou addressed this change in his 1908 annual report, which you will find to be most interesting (Cortelyou, 1908, p. 45-46). The italics are mine. It was deemed advisable, also, that the backs of these notes should bear some suitable inscription connecting them with the new act and differentiating them from previous issues. This was readily accomplished on the plates of the series of 1902 by adding the numbers "1902-1908," but as the series of 1882 had backs of an inartistic design, expensive to print, and bore the coats of arms of the different States, making it necessary to carry in stock a full supply for each State, it was considered to be an opportune time to prepare a new design for these backs, and new plates were accordingly prepared. This work commenced immediately after the passage of the act, the first back plate altered in accordance therewith having been send to press June 5, and the first delivery of the new currency made to the Comptroller of the Currency June 15, showing commendable promptness on the part of the bureau in the prosecution of the work. Work commenced at the Bureau immediately after passage of the act. Nearly 10,000 face plates had to be altered and $500,000,000 in notes printed as soon as possible (Bureau of Engraving and Printing, 1908, p. 4). The first altered face went to press on June 5, 1908, and deliveries to the Comptroller began on June 15 consisting of 5-5-5-5 Series of 1902 blue seal date backs, the first of which was the A1-1-A,B,C,D 5-5-5-5 sheet for The First National Bank of Beaver City, Utah (9119). The first Series of 1882 date back sheets were delivered to the Comptroller on August 1, 1908, including 5-5-5-5 and 10-10-10-20 sheets.

"... Or Other Securities" Clause Added The production of the Series of 1882 and 1902 date backs was accomplished rapidly by altering the existing face plates by adding the "or other securities" clause and advancing the plate letters. For example, a 10-10-10-20 red seal plate with letters A-B-C-A was altered to carry plate letters D-E-F-B along with the revised security clause. The dates, 1902-1908, were added to the backs of the Series of 1902 plates, whereas new Series of 1882 back plates were prepared using only the borders from the previous brown back plates surrounding the 1882-1908 date. Both the treasury and bank sheet serials reverted to 1 for every sheet combination issued by every bank. No $500, $1000 or $10,000 notes were ordered by the banks, so plates for these denominations never were prepared for either the Series of 1882 or 1902. EMERGENCY CURRENCY

World War I broke out in Europe at the beginning of August, 1914, and the situation changed radically. Kane (1922, p. 445-447), who at the time was serving as Deputy Comptroller, provides an insider's view of what transpired. At this juncture the Aldrich-Vreeland emergency currency measure proved of great aid to the financiers and bankers. Although this law had been in existence since immediately following the panic of 1907, it had never been utilized and probably never would have been had it not been for the grave emergency created by the European war. The Secretary of the Treasury realized the gravity of the situation, and on August 3 announced through the press that the Treasury Department was prepared to immediately issue to national banks in New $100,000,000 of additional currency authorized by this act. The net impact of the emergency currency issues in 1914 and 1915 was to drive the total outstanding value of national bank notes to an all-time record number. The national bank note supply ballooned from about $700 million to $1.1 billion by the end of October, 1914. This circulation quickly contracted as the stringency passed owing to the high tax on the emergency issues. DISCUSSION

The result was that the provisions of the act were never invoked by the banks to provide elasticity as needed during the normal annual business cycle or the longer-term recession-inflation cycles that plagued the economy. Consequently, the national currency supply remained inflexible. The fact was that no currency ever would have been issued under the terms of the Aldrich-Vreeland Act was it not for the extreme financial crisis precipitated by the outbreak of World War I. Rather than tinker further with national bank currency, Congress established the Federal Reserve System in 1913, with its elastic currency, a move that ultimately rendered national bank currency obsolete.

That was a lengthy excerpt, but I think it covers the essence of the situation. The answer to my question was indeed hiding in plain

sight. The emergency issues for the panics of 1893 and 1907 solved a real need, but by 1914 the need was largely met by the National Bank

Notes issued under the Aldrich-Vreeland Act.

But there were indeed some scrip notes issued during the panic of 1914; I've just never encountered them because they're so rare in comparison. I could have learned that just from the title of the recent book by Neil Shafer and Tom Sheehan on Panic Scrip of 1893, 1907 and 1914. Part III of the book, beginning on p337 covers 1914. Several states and the District of Columbia produced one or two scattered issues of scrip, some of which were Clearing House Certificates; others were from individual banks or companies. I've been unable to locate any images of these online, although a number are illustrated in black-and-white in the book. Thanks, Peter, for your great explanation. Now it all makes some sense! Thanks also to Pablo Hoffman for sending the original article that kicked off this interesting discussion. -Editor To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|