PREV ARTICLE

NEXT ARTICLE

FULL ISSUE

PREV FULL ISSUE

INFLATION-INDEXED BONDS IN EARLY AMERICAAn article found via News & Notes from the Society of Paper Money Collectors (Volume X, Number 10, August 20, 2024) discusses inflation-indexed Bonds in early America. From the Tontine Coffee-house history of finance blog. -Editor

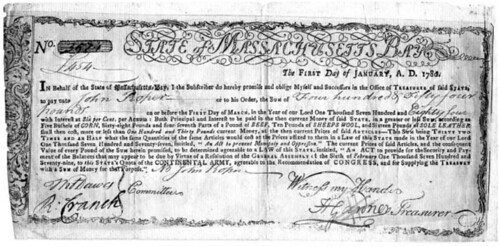

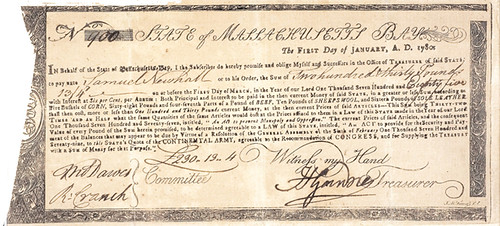

Colonial America was fertile ground for monetary experimentation. Circulating as money would have been precious metal coins, and not only English coins but also others, paper money issuances from the various colonial governments, often circulating in their neighboring colonies as well, and even commodities widely accepted as money. Many colonies over-issued their paper money, including Massachusetts. The result was depreciation of the money and inflation in prices. Because of this, the government of Massachusetts was ultimately pressured to issue an inflation-linked bond, one that would protect its holder from inflation. Precious metal coins were not the dominant form of money in the American colonies for much of the 17th and 18th centuries. Paper money, and even commodities like tobacco and beads, circulated more widely than metal coins. To fund an unsuccessful 1690 invasion of Quebec during the War of the Grand Alliance, the colony of Massachusetts issued paper money. It promised to redeem these notes at a later date but they began to circulate as money in the colony in the meantime; they could also be used in payment of debts to the state, such as tax obligations. More notes were issued to fund the colony's expenses during the War of the Spanish Succession between 1702 and 1713. Thereafter, the government continued to issue paper money in peacetime. These included notes issued by the colonial government and notes issued by the colony's land bank in the funding of loans; in either case they were called ‘bills of credit'. Massachusetts notes were issued in volumes that exceeded the colonial government's ability to redeem them. This was especially true after 1740, when the stock of notes in circulation per capita would grow by 5.6 times over the next decade. However, in a positive development, money was delivered from Britain to compensate the colony for its expenses borne during the War of the Austrian Succession, which ended in 1748. The money was used to redeem notes issued to finance that war. So, just after the midpoint of the century, there was a tight money supply and monetary stability. According to the future Secretary of the Treasury, Alexander Hamilton, the money supply of the American colonies was approximately three-parts paper money to one-part precious metal specie just before the War of Independence. However, far more paper money was issued during that war. In Massachusetts, this began with a rather modest issuance of 26,000 Massachusetts pounds in May 1775; hundreds of thousands pounds more would soon follow. Inflation-Linked Notes Soldiers complained regularly about the lack of pay and, when they were paid, the depreciation of the money they were paid in. In January 1779, four battalions from Massachusetts petitioned for relief claiming that by the effect of depreciation they were losing seven-eighths of their pay. The next month, the government agreed to right this wrong, but only after the war ended. Being an unsatisfactory response, worries existed that if the issue were not addressed, soldiers would decline to renew their enlistments. Some were already taking second jobs in between the fighting. Soldiers' mutinies occurred in the colonies during the late years of the War of Independence. Thus, an accelerated resolution was called for. Massachusetts established a committee in November 1779 to address the issue of soldier pay. The solution devised was a new instrument that would be linked to the price of various goods and legislation was passed in January 1780 to issue these new notes. Massachusetts issued a rather new kind of obligation, an inflation-linked note, that year. They were used to pay the soldiers and were known as ‘depreciation notes' or ‘soldiers depreciation notes'. They accrued interest at 6% per year and were more akin to a bond than a banknote; as such, they did not circulate as money. This was arguably the first inflation-linked bond, at least insofar as it was linked to a well-defined price index, rather than a single commodity. Each note was indexed to the price of five bushels of corn, sixty-eight and four-sevenths pounds of beef, ten pounds of wool, and sixteen pounds of leather. The seemingly strange proportion of these commodities was set so that each was equally weighted according to their value in the index. From then on, a committee comprised of men from a few different counties of Massachusetts would track prices and report these to the state. Taken together, this basket of commodities was worth about one hundred and thirty Massachusetts pounds as of January 1, 1780, or just over thirty-two times more than they would have cost under the price-fixing law from three years earlier. The price of each of the four components of the index was about one Massachusetts pound back in 1777 revealing just how much the local pound had lost value. The inflation-linked notes were issued with maturity dates ranging from 1781 to 1788; those soldiers who committed to serve through the end of the war received the notes maturing sooner, between 1781 and 1784. Those who declined received the later-dated notes. We illustrated one of these last year, image provided by Roger Moore. -Editor Roger adds: "The most authoritative reference on these I have is: William Anderson, The Price of Liberty, University of Virginia Press, Charlottesville, 1983, p. 89 listing #97. A cheaper reference but still a nice one to have in your library is: Udo Hielscher, Financing the American Revolution, Museum of American Financial History, New York, 2003, p. 23, listing #22. This ties into an article I am writing for C4N at the moment."

To read the complete article, see:

To read the earlier E-Sylum article, see:

Wayne Homren, Editor The Numismatic Bibliomania Society is a non-profit organization promoting numismatic literature. See our web site at coinbooks.org. To submit items for publication in The E-Sylum, write to the Editor at this address: whomren@gmail.com To subscribe go to: https://my.binhost.com/lists/listinfo/esylum All Rights Reserved. NBS Home Page Contact the NBS webmaster

|